Technology

Ranked: The Largest Bitcoin ETFs in the U.S.

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Ranking the Largest Bitcoin ETFs in the U.S.

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In early January 2024, the U.S. Securities and Exchange Commission (U.S. SEC) gave its approval on exchange-traded funds (ETFs) to track Bitcoin, giving investors an alternative pathway to accessing the world’s biggest cryptocurrency.

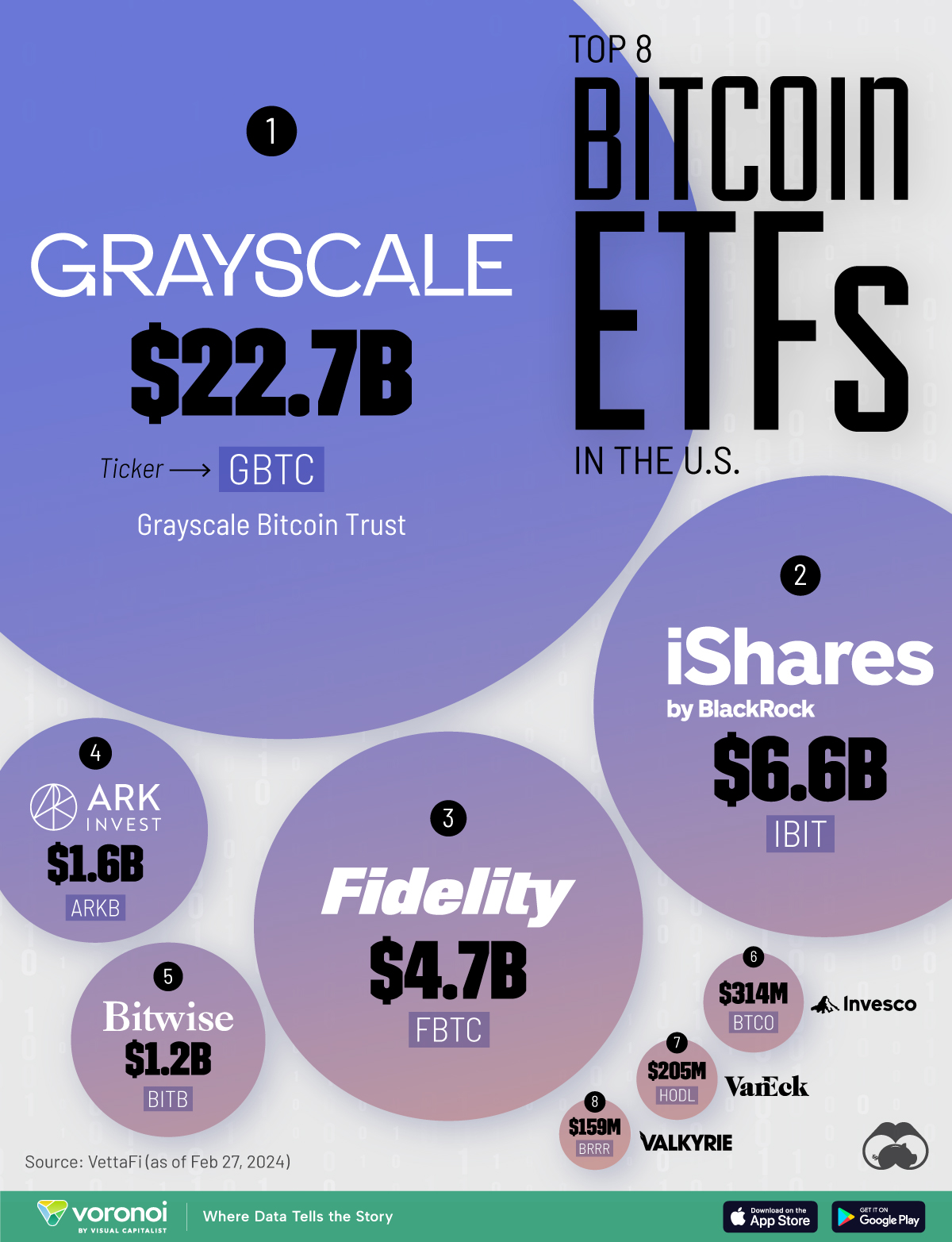

In this graphic, we’ve shown the eight largest Bitcoin ETFs in the U.S. by assets under management (AUM), as of Feb. 27, 2024. To elaborate, these are ETFs that buy and hold actual Bitcoin, meaning their performance will generally follow that of Bitcoin itself.

The data used to create this graphic was sourced from VettaFi.

| ETF Name | Ticker | AUM |

|---|---|---|

| Grayscale Bitcoin Trust | GBTC | $22.7B |

| iShares Bitcoin Trust Registered | IBIT | $6.6B |

| Fidelity Wise Origin Bitcoin Fund | FBTC | $4.7B |

| ARK 21Shares Bitcoin ETF | ARKB | $1.6B |

| Bitwise Bitcoin ETF Trust | BITB | $1.2B |

| Invesco Galaxy Bitcoin ETF | BTCO | $314M |

| VanEck Bitcoin Trust | HODL | $205M |

| Valkyrie Bitcoin Fund | BRRR | $159M |

From these numbers we can see that Grayscale’s Bitcoin Trust (GBTC) is the largest by a wide margin. As its name implies, GBTC was originally structured as a trust, but was converted to an ETF on Jan. 11, 2024.

Why Buy a Bitcoin ETF?

Bitcoin ETFs simplify the process of buying and storing Bitcoin. This is because they can be purchased within a traditional brokerage account, just like any other ETF or stock.

Instead of having to think about creating a wallet, memorizing a 12-word seed phrase and holding their keys, this product scraps all of that and provides a well-known path: buy an ETF. This will open the digital asset space to a broader investor base.

Rita Martins, former Head of FinTech Partnerships, HSBC

Investors should be aware that these ETFs charge an expense ratio, which could eat into returns. Information on fees can be easily found on each asset manager’s relevant fund page.

For more visualizations related to Bitcoin, consider this graphic which shows how Bitcoin has performed relative to other major asset classes over the past 10 years.

Technology

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

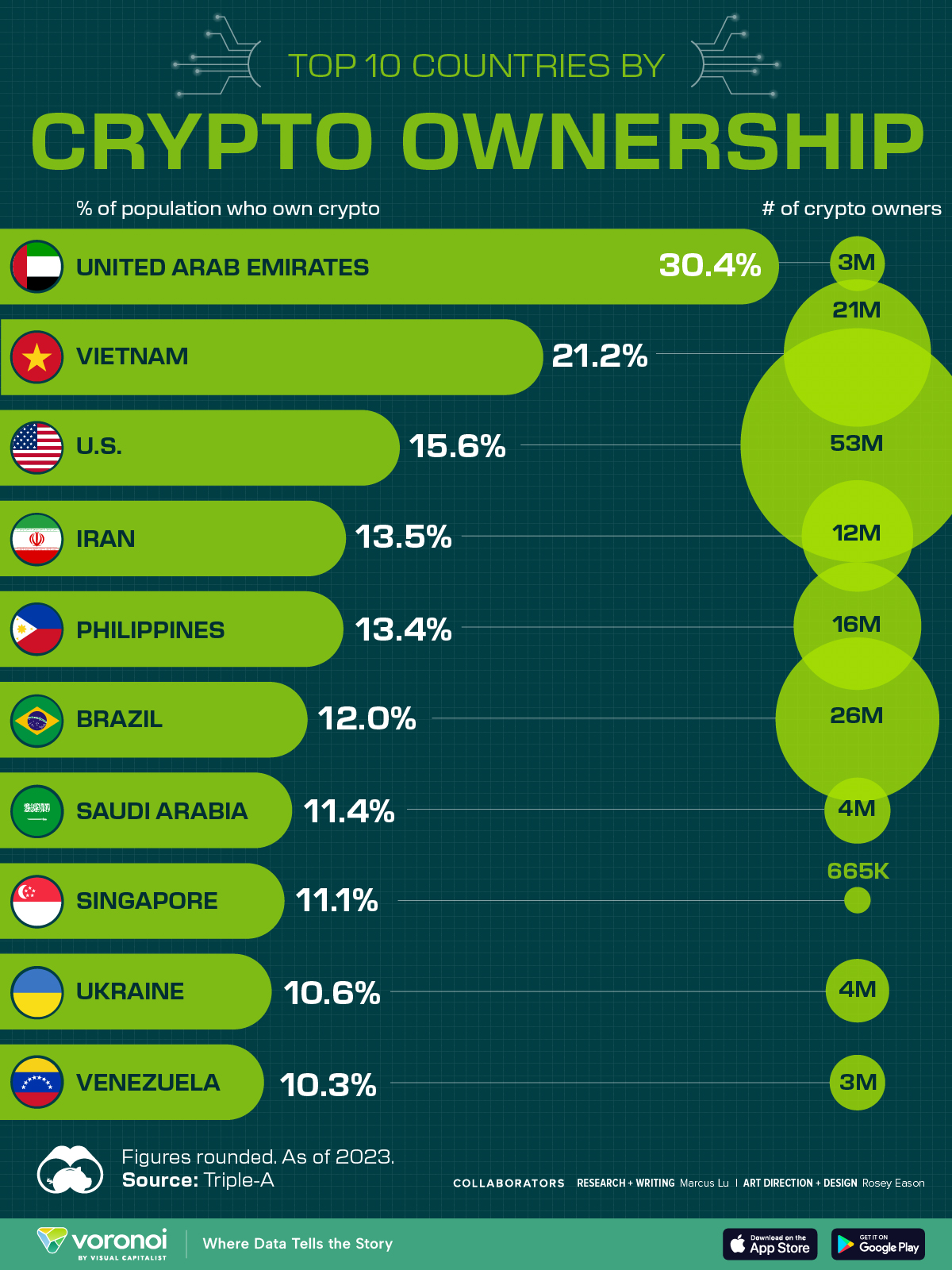

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Brands5 days ago

Brands5 days agoThe Evolution of U.S. Beer Logos

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi2 weeks ago

voronoi2 weeks agoBest Visualizations of April on the Voronoi App

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which Country Has the Most Billionaires in 2024?

-

Markets1 week ago

Markets1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn

-

Economy1 week ago

Economy1 week agoRanked: The Top 20 Countries in Debt to China

-

Misc1 week ago

Misc1 week agoCharted: Trust in Government Institutions by G7 Countries