Topic

The world’s second-largest cryptocurrency exchange collapsed in November 2022, putting its leaders, including 30-year-old founder Sam Bankman-Fried, into the headlines and under the legal spotlight.

In light of the cryptocurrency industry’s crisis, insiders can no longer claim they are above regulation or that governments just don’t ‘get it’. The hype has turned out to be just like any other financial manias of the past

- FTX said in a court filing it owes about US$11.2 billion to its creditors, and estimates it has between US$14.5 billion and US$16.3 billion to distribute to them

- FTX was the world’s third-largest cryptocurrency exchange when it filed for bankruptcy protection in November 2022 after experiencing the equivalent of a bank run

US District Judge Lewis Kaplan handed down the sentence after rejecting Bankman-Fried’s claim that FTX customers did not actually lose money and accusing him of lying during his trial testimony.

The increased interest in bitcoin reflects how a community of cryptocurrency enthusiasts on the mainland continues to thrive, despite a sweeping government ban.

The successful US launch of spot bitcoin exchange-traded funds is expected to help move Hong Kong regulators closer to authorising similar cryptocurrency funds to operate in the city.

US regulators for the first time approved ETFs that invest directly in bitcoin, a move heralded as a landmark event for the roughly US$1.7 trillion digital-asset sector.

In 2023, 17 jurisdictions including Hong Kong, the EU, South Korea, Singapore, and the US, tightened cryptocurrency regulations, according to a report by TRM Labs.

This initiative shows Hong Kong policymakers’ determination to rebuild investor confidence in virtual assets, following a number of major financial scandals involving cryptocurrencies.

Fintech start-up OneDegree’s optimistic projection stems from the positive performance of the company’s household pet and digital-asset insurance operations.

The former crypto tycoon was found guilty by a New York jury on all seven counts of fraud, embezzlement and criminal conspiracy. He faces decades in prison.

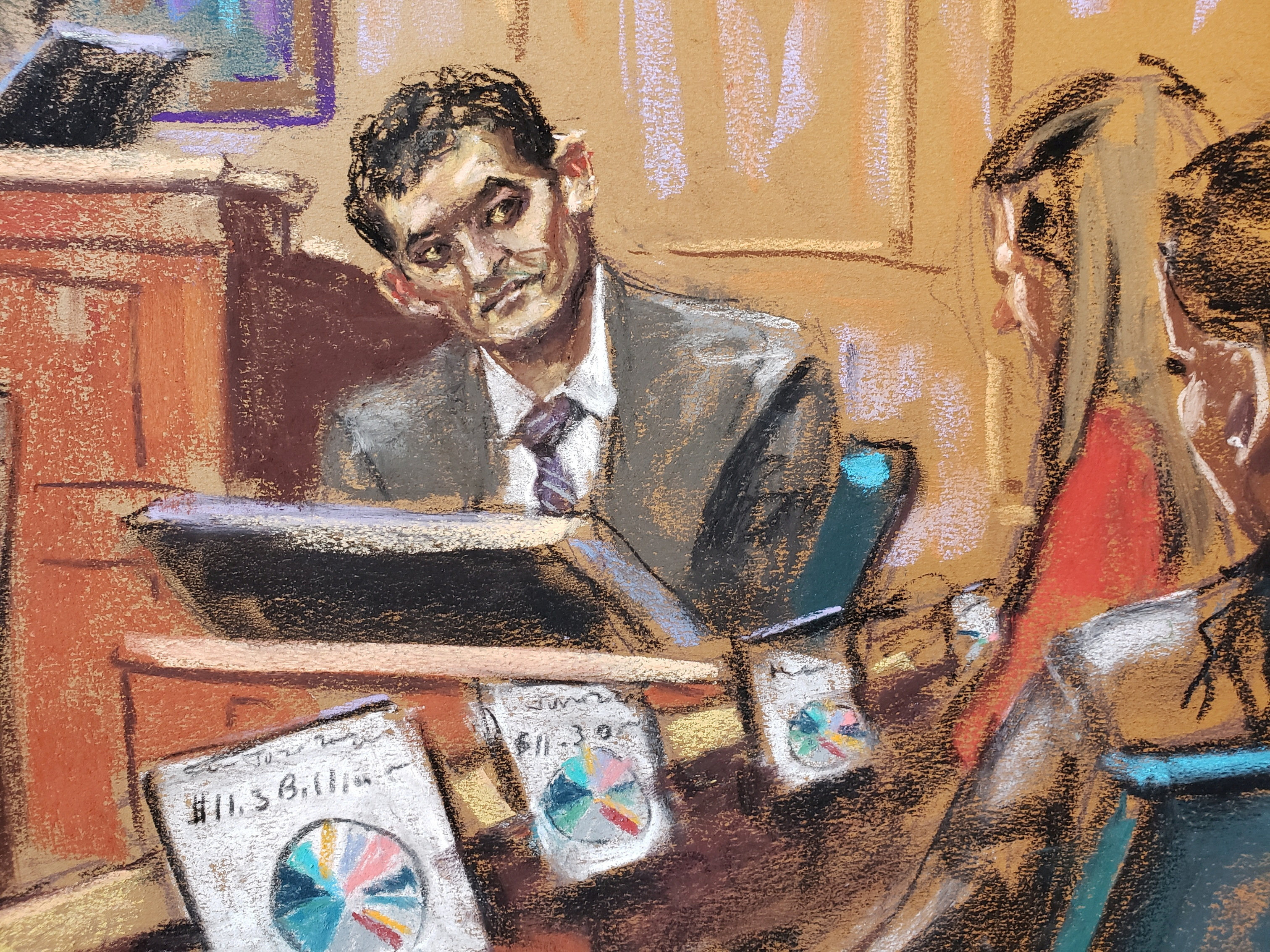

The FTX founder, testifying in his own defence at his fraud trial in New York, said he was surprised but not alarmed that his Alameda Research hedge fund had borrowed US$8 billion from FTX customer deposits.

Cryptocurrency exchange FTX co-founder Gary Wang Zixiao said in court that former partner Sam Bankman-Fried knowingly used clients’ funds without permission to invest through his personal hedge fund, Alameda Research.

The city state’s sovereign wealth fund said its senior management and investment team were ‘ultimately responsible’ for investing in the now-bankrupt cryptocurrency exchange, which resulted in a US$275 million writedown.

Bankman-Fried had earlier pleaded not guilty to 8 counts of fraud and conspiracy for allegedly stealing billions in FTX customer funds.

Source says Amber Group is cutting costs and jobs across the board amid ongoing crypocurrency market turmoil from last year’s FTX collapse.

The ex-cryptocurrency boss, who is accused of cheating investors and looting customer deposits, will face trial in October.

FTX founder Sam Bankman-Fried and former executive Gary Wang borrowed more than US$546 million from Alameda Research to buy a nearly 8 per cent stake in Robinhood Markets, according to court papers.

The Justice Department investigation into the stolen assets is separate from a fraud case against FTX co-founder Sam Bankman-Fried, a report said.

The statements by Ellison and Wang undermine Sam Bankman-Fried’s repeated claims that he was “unaware” of what went on at Alameda, the trading unit of FTX.

More than 330 alleged victims have contacted the force’s commercial crime bureau over Atom Asset Exchange.

The statement was the first acknowledgement by Binance in the face of mass withdrawals following the November 11 bankruptcy of its smaller rival FTX.

The cryptocurrency entrepreneur can live in his parent’s home, while awaiting trial on charges that he swindled investors and looted customer funds, judge says.

The charges on Wang and Ellison widened the dragnet over FTX’s November 11 bankruptcy under US$3 billion of debt, which had previously focused on the role played by SBF, the public face of the exchange.

Cryptocurrency trading firm Auros has applied for a form of provisional liquidation that will allow it to explore restructuring options after struggling to pay creditors amid the collapse of FTX.

In light of the uncertainty of centralised finance, users need ways to transact and move funds with ease and security more than ever before. Individuals must be empowered to take control of their cryptocurrency keys.

The 30-year-old cryptocurrency mogul is expected to appear in court in the Bahamas on Monday to reverse his decision to contest extradition to the US, where he faces fraud charges.

The bare-bones indictment suggests it was put together quickly and prosecutors need time to piece together evidence of fraud.

Binance faces new challenges in reassuring investors about its holdings after accounting firm Mazars Group halted work for crypto firms.

Zhao Changpeng said ‘things seem to have stabilised’ after reports questioning the company’s health spurred US$1.14 billion in withdrawals in 12 hours.