Global Cryptocurrency Exchange Platform Market Size, Share, and COVID-19 Impact Analysis By Cryptocurrency (Bitcoin, Ethereum, Cardano, Solana and Others), By End-use (Commercial and Personal) and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 – 2030

Industry: Information & TechnologyGlobal Cryptocurrency Exchange Platform Market Share Insights Forecasts to 2030

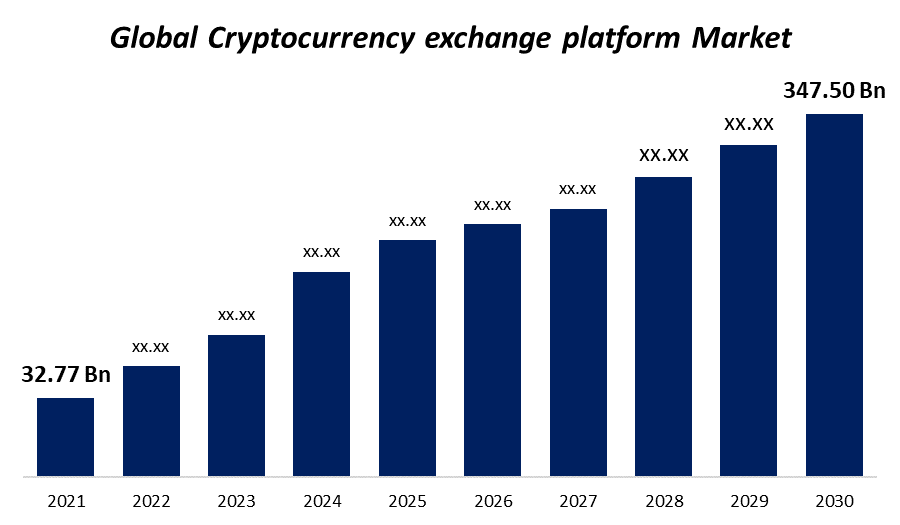

- The Global Cryptocurrency Exchange Platform Market Size was valued at USD 32.77 billion in 2021.

- The Market is growing at a CAGR of 30.08% from 2021 to 2030

- The Worldwide Cryptocurrency Exchange Platform Market Size is expected to reach USD 347.50 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Cryptocurrency exchange platform Market is expected to reach USD 347.50 billion by 2030, at a CAGR of 30.08% during the forecast period 2021 to 2030. The sector is expanding due to growing public awareness of cryptocurrencies and their benefits, including flexibility and security. Due to the development of blockchain technology, there is a great emphasis on safe and decentralized networks, which is positive for market expansion. The demand for the cryptocurrency exchange market is expected to rise as digital assets such as cryptocurrencies and Non-Fungible Tokens (NFTs) increase in popularity. Digital currency is quickly being embraced by people in industrialized nations like the U.S. and Canada because of its versatility and ease of transaction use. Additionally, the cryptocurrency exchange market is anticipated to benefit from the increasing use of mobile-based trading systems.

Market Overview

Private platforms known as cryptocurrency exchanges enable the trade of cryptocurrencies for other crypto assets, such as digital and fiat money and NFTs. The cryptocurrency exchange is an online market where users may trade, buy, and sell cryptocurrencies. Like online brokerages, cryptocurrency exchanges allow users to deposit fiat currency (like dollars) and buy cryptocurrencies with those funds. You can invest directly with USD; Coinbase is the most well-known and finest cryptocurrency exchange. Currently, the platform allows you to buy Bitcoin, Ethereum, Litecoin, and more than 30 additional coins and tokens. The demand for cryptocurrency exchange platforms is expected to rise as digital assets like cryptocurrencies and Non-Fungible Tokens (NFTs) gain popularity. Digital currency is quickly being embraced by people in industrialized nations like the U.S. and Canada because of its adaptability and ease of transaction use. Additionally, the business is anticipated to benefit from the growing use of mobile-based trading systems. Cryptocurrencies also use blockchain technology for efficient and decentralized transactions. The lack of regulations and a clear standard for exchange platforms and digital money will likely prevent the widespread use of cryptocurrencies, a relatively new financial technology. Regulators from all over the world are concerned about the use of these platforms for illegal activity, which is a significant barrier to the market's expansion. On the other side, the benefits that blockchain technology and cryptocurrencies offer outweigh the rise in illicit activity. The government authorities also have the power to control exchanges so they may keep an eye out for suspicious activity and prevent such actions. Most people began investing in cryptocurrency during the COVID-19 outbreak to increase their Return-On-Investment (RoI). Surprisingly, since most financial markets were affected by the global outbreak, more traders and investors shifted to safer and more reliable digital currencies. People made the decision to invest in cryptocurrencies to safeguard their interests and guarantee at least a minimal return on their capital. As a result, the COVID-19 epidemic increased demand for bitcoin exchange platforms and opened doors for market expansion.

Report Coverage

This research report categorizes the Market for global Cryptocurrency based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Cryptocurrency exchange platform Market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the Market. The report strategically identifies and profiles the key Market players and analyses their core competencies in each global Cryptocurrency exchange platform Market sub-segments.

Global Cryptocurrency Exchange Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 32.77 billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 30.08% |

| 2030 Value Projection: | USD 347.50 billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Cryptocurrency, By End-use, By Region, COVID-19 Impact Analysis |

| Companies covered:: | BlockFi International Ltd., Coinmama, eToro, Coinbase, Binance, Kraken, Bitstamp, Coincheck, Inc., FTX Trading Ltd., AirSwap |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the Bitcoin segment dominated the Market with the largest Market share of 33.1% and Market revenue of 10.8 billion.

Based on Cryptocurrency, the global Cryptocurrency exchange platform Market is categorized into Bitcoin, Ethereum, Cardano, Solana, and Others. In 2021, the Bitcoin segment dominated the Market with the largest Market share of 33.1% and Market revenue of 10.8 billion. Since the Bitcoin Foundation of cryptocurrencies and created the cryptocurrency industry, Bitcoin is considered the dominant cryptocurrency. As a result, Bitcoin has an impact on the entire cryptocurrency market. Additionally, the growth of several altcoins, including Litecoin, Bitcoin Cash, and Bitcoin Diamond, is expected to accelerate in the upcoming years. The need for Bitcoin exchange platforms is increased because Bitcoin is thought to be the most dependable and secure network.

- In 2021, the Commercial segment accounted for the largest share of the Market, with 70.3% and a Market revenue of 23.0 billion.

Based on the End-use, the Cryptocurrency exchange platform Market is categorized into Personal and Commercial. In 2021, the Commercial segment accounted for the largest share of the Market, with 70.3% and a Market revenue of 23.0 billion. Throughout the projection period, the segment's growth is anticipated to be driven by millennials in developing nations like India and Nigeria. They are becoming more knowledgeable about cryptocurrencies. Because they do not want to limit themselves to conventional investment vehicles, which are supposed to support industrial growth, people are looking for other investment possibilities. As a result, the segment expansion is anticipated to be supported by the rising number of cryptocurrency traders and investors in developing nations.

Regional Segment Analysis of the Cryptocurrency exchange platform Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

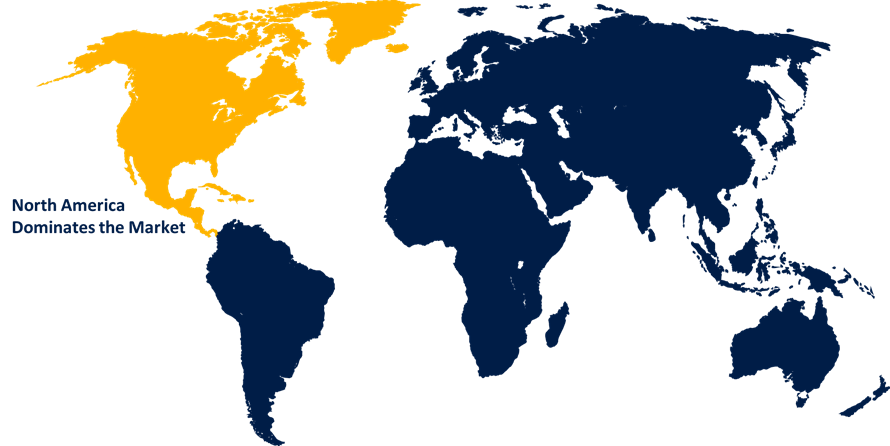

North America emerged as the largest Market for the global Cryptocurrency exchange platform Market, with a Market share of around 30.35% and 9.94 billion of the Market revenue in 2021.

- North America emerged as the largest Market for the global Cryptocurrency exchange platform Market, with a Market share of around 30.35% and 9.94 billion of the Market revenue in 2021. The demand for cryptocurrency exchange platforms is being driven by the rising acceptance of cryptocurrencies as a form of value storage and their use in NFTs in the area. Additionally, the supremacy is credited to the presence of a number of important players in the area, including Gemini, Kraken, and others, as well as the actions done by numerous firms to satisfy client expectations. For instance, in June 2021, 650 banks, credit unions, and NCR Corp. collaborated to offer cryptocurrencies.

- Asia Pacific Market is expected to grow at the fastest CAGR between 2021 and 2030, owing to the increasing encouragement and benefits for foreign businesses to enter the region. The region is expanding because rising nations like China and India have accepted cryptocurrencies. The expansion of the region is also aided by significant players' strategic alliances and joint ventures.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global Cryptocurrency exchange platform Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment Market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the Market.

List of Key Market Players:

- BlockFi International Ltd.

- Coinmama

- eToro

- Coinbase

- Binance

- Kraken

- Bitstamp

- Coincheck, Inc.

- FTX Trading Ltd.

- AirSwap

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In June 2022- A Canadian-based cryptocurrency trading platform called Bitvio, Inc., was acquired by cryptocurrency exchange FTX. With this acquisition, FTX hoped to broaden its reach internationally; the agreement is expected to be finalized by the third quarter of the fiscal year 2022. Recognizing the promise of cryptocurrencies, several fintech companies are investing aggressively in the cryptocurrency industry.

- In July 2022- An exchange platform for cryptocurrencies was launched by PicPay, a Brazilian fintech business, to give its users access to Ether, Bitcoin, and Paxos' USDP stablecoin.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global Cryptocurrency exchange platform Market based on the below-mentioned segments:

Global Cryptocurrency exchange platform Market, By Cryptocurrency

- Bitcoin

- Ethereum

- Cardano

- Solana

- Others

Global Cryptocurrency exchange platform Market, By End-use

- Commercial

- Personal

Global Cryptocurrency exchange platform Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?