The Federal Reserve is the central bank of the United States, but many people are unclear about what it actually does. While the Federal Reserve isn’t a bank in the sense that you or I could open a checking or savings account there, it does play a very important role -- both directly and indirectly -- in the financial lives of most Americans. In this article, we’ll take a look at what the Federal Reserve is, why it exists, and what it does.

Overview

The Federal Reserve defined

The Federal Reserve, often referred to as “the Fed,” is the central bank of the United States.

The Federal Reserve exists to create control over the United States monetary system. It was created in 1913 in response to a banking panic, with a goal of ensuring that similar panics would be better controlled in the future.

The Fed’s central purpose is what’s called the dual mandate -- to maximize employment and to stabilize prices. In other words, the Federal Reserve’s goal is to keep inflation low while simultaneously keeping the unemployment rate as low as possible. It also aims to moderate long-term interest rates, which essentially means keeping the long-term average interest rate as low as possible while achieving its other objectives.

In addition, the Federal Reserve is responsible for regulating the banking industry. You may have heard of bank “stress tests,” which are annual reviews, conducted by the Federal Reserve, of how a bank would perform in a hypothetical economic downturn. The Fed also acts as a “lender of last resort” to ensure that a bank run doesn’t restrict access to savings deposits.

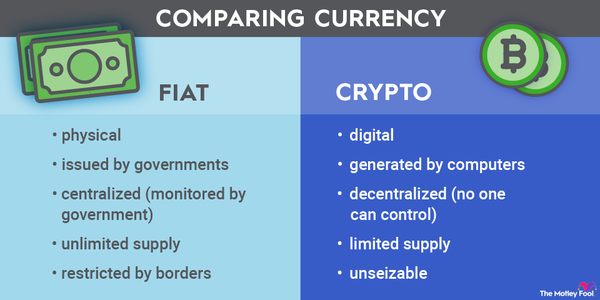

The Fed also provides banking services to banks as well as to the U.S. government. The U.S. Treasury maintains an account at the Federal Reserve, and if you’ve ever received a tax refund check, that’s the account it was written on. It also buys, sells, and redeems government securities such as Treasury bonds and is the issuer of our fiat currency. The label “Federal Reserve Note” is prominently displayed on U.S. paper money.

The Federal Reserve is technically a government agency, but in practice it operates independently of the government. The Fed’s actions don’t require approval by any of the three branches of the federal government. It doesn’t receive public funding (the Fed actually makes money on its own), but it was created and granted authority by Congress.

Expert views

Academic views on the Federal Reserve

Domenico Ferraro, PhD

The Motley Fool: How does the Fed use interest rates to control inflation?

Domenico Ferraro, PhD: “This question is more complex than typically addressed in textbooks. The Fed cannot control inflation alone. Inflation is always a joint monetary-fiscal phenomenon.

When the government is seen as fiscally responsible, the Federal Reserve has some control over inflation by adjusting the short-term nominal interest rate or the money supply. Raising the short-term interest rate leads to an increase in long-term interest rates, which raises the cost of capital. As a result, both consumers and corporations tend to postpone spending on durable goods and investments. This reduction in spending decreases total demand, which in turn helps to lower inflation.

If the government fails to be fiscally responsible, the Federal Reserve’s ability to control inflation diminishes. When the Fed raises interest rates, the government’s costs for servicing its debt increase. The government has two choices: It can either raise taxes, which would help the Fed regain some control over inflation, or it can issue new debt without increasing taxes, which could lead to higher inflation instead of lower.”

The Motley Fool: How does the stock market react to Federal Reserve interest rate decisions?

Domenico Ferraro, PhD: “Typically, the stock market tends to react positively to a reduction in the federal funds rate. This positive reaction occurs because lower current interest rates are often linked to lower future interest rates, which implies a higher present discounted value (PDV) of future profits. However, recently, reductions in short-term nominal interest rates by the Federal Reserve have been associated with increases, rather than decreases, in long-term interest rates. As a result, the relationship between Federal Reserve interest rate decisions and the stock market has become more uncertain.”

The Motley Fool: How do Fed policies impact the value of the U.S. dollar in global markets?

Domenico Ferraro, PhD: “When the Fed raises the nominal interest rate, investors tend to purchase dollar-denominated assets that offer a higher rate of return. As a result, they will purchase dollars on the foreign exchange market, strengthening the nominal exchange rate of the US dollar against other currencies.”

Robert S. Goldberg

The Motley Fool: How does the Fed use interest rates to control inflation?

Robert S. Goldberg: “The Federal Reserve sets the rate on overnight bank reserves, and this rate drives all other borrowing costs, from consumer loans to mortgages to corporate borrowings. By increasing rates, the Federal Reserve slows down the demand for funds by raising the cost of borrowing for businesses and consumers, and this slowing demand helps to reduce inflationary pressures.”

The Motley Fool: How does the stock market react to Federal Reserve interest rate decisions?

Robert S. Goldberg: “The stock market reacts in different ways to Federal Reserve rate decisions. The market might sell off if it perceives the Fed is playing catch-up to inflationary pressures, needing to raise rates above an otherwise neutral level. However, modest rate increases associated with an improving economy might elicit a positive reaction from the market if it senses that the Fed is confirming good news about the economy. On the flip side, a decrease in rates might be viewed positively if it is associated with a view that the Fed has won the battle on inflation and the economy is on solid ground, while a sharp decrease in rates might elicit a negative reaction from the market if investors feel the Fed is panicking to avert a significant slowdown in economic activity.”

Components

Components of the Federal Reserve

These are a few important parts of the Federal Reserve:

- Federal Reserve Board: This is a seven-member board appointed by the president. The board is responsible for establishing the discount rate, the interest rate the Fed charges commercial banks when they borrow money. The board also is responsible for regulating reserve requirements for financial institutions.

- Regional Federal Reserve Banks: The Federal Reserve has 12 regional branches located in major cities throughout the country. These are the banks that commercial banks deal with to use lending facilities and for other purposes.

- Federal Open Market Committee (FOMC): This is the policy-making arm of the Federal Reserve. The group is very significant to both investors and consumers, so we’ll discuss it in greater detail.

Merchant Banking

The Federal Open Market Committee

The Federal Open Market Committee

Have you ever heard somebody say, “The Fed raised interest rates,” or something similar? They’re actually referring to the Federal Open Market Committee (FOMC). The names Federal Reserve and FOMC are often used interchangeably, but they actually refer to distinct entities.

The FOMC is the 12-member group of Federal Reserve directors that is responsible for setting the federal funds rate, the benchmark interest rate that affects many other interest rates for consumers and businesses. For example, your credit card’s interest rate is directly linked to the federal funds rate.

The FOMC consists of the seven members of the Federal Reserve Board, the president of the New York Federal Reserve Bank, and a rotating group of four of the 11 other Federal Reserve Bank presidents.

The committee meets eight times per year to review current economic conditions and make the decision to raise, lower, or maintain the federal funds rate. It also controls the purchases and sales of U.S. Treasury and other government securities on the open market (hence the “open market” designation in its name, although the federal funds rate is the committee’s preferred method of loosening or tightening monetary policy).