We knew it was coming, but stock-trading platform Robinhood is finally open for business in the U.K. — its first international market since debuting in the U.S. more than a decade ago.

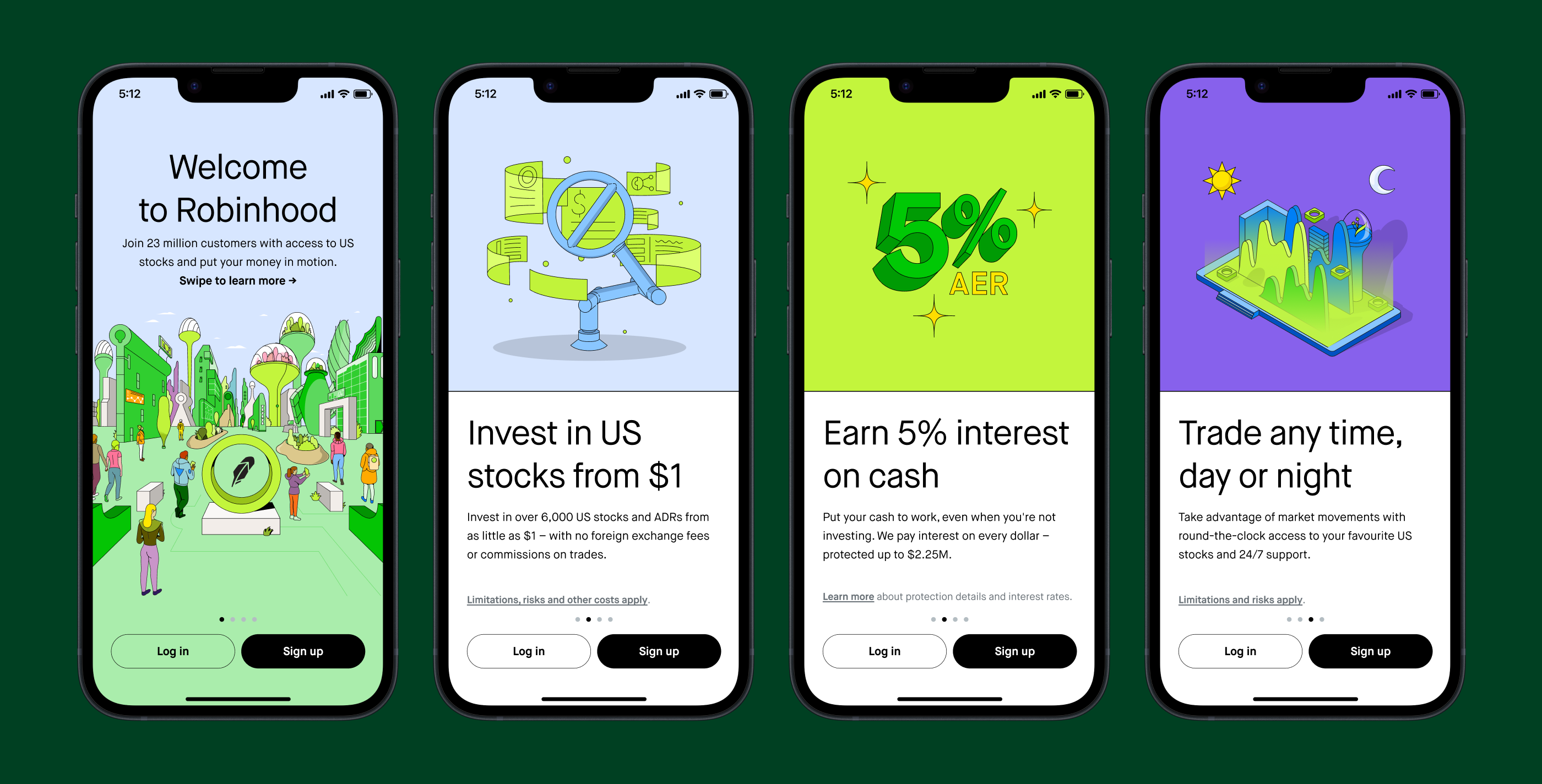

Robinhood is granting early access to the app starting today for those who join the waitlist, with things gradually opening up to everyone across the U.K. some time in early 2024.

The Menlo Park, California-based company began its U.K. launch prep nearly five years ago, starting with a local hiring spree, eventually launching a waitlist for users in late 2019 before abruptly pulling the plug in mid-2020. The company never really gave a full explanation for the decision, merely noting that “a lot has changed these past few months” and that it wanted to focus on its U.S. business.

In truth, the company was facing mounting pressure at home, including allegations that it was misleading customers and using cynical gamification strategies to entice inexperienced users to make risky trades. The company has also been hit with several multimillion-dollar fines over system outages and other misdemeanors.

And tragically, 20-year-old student Alex Kearns died by suicide after seemingly misinterpreting a negative balance of $730,000 in his Robinhood account, with the company eventually settling a private lawsuit brought by his family.

Despite all this, Robinhood became a publicly traded entity in mid-2021. The company now claims 23 million users domestically, though much of this growth was spurred by early-lockdown boredom as people hunkered down at home, growing from 11.7 million monthly users in December 2020 to more than 21 million six months later. Remember meme stocks? Yup, Robinhood was a major protagonist in that whole affair.

So what does this all mean for Robinhood now, as it takes a second shot at international expansion?

“We’ve certainly learned from our previous launch attempt, and as a business we’ve grown and matured to a level where we’re 23 million customers, $87 billion in assets, and a listed business,” Jordan Sinclair, Robinhood’s U.K. president, explained to TechCrunch. “We’ve also built technology that allows us to scale internationally.”

However, much has changed elsewhere since Robinhood’s last launch attempt. A number of local players have gained steam for starters, notably Richard Branson-backed Lightyear, which started out by allowing U.K. consumers to trade U.S. stocks before expanding to support European users and stocks. And then there is Freetrade, where Sinclair previously served as European managing director before joining Robinhood this summer. Freetrade supports U.K.-based traders investing in U.S. and European stocks, and it expanded into Sweden last year.

It’s these younger upstarts that Robinhood will most likely be up against at first, rather than dusty old legacy financial services firms such as Hargreaves Lansdown.

“Robinhood’s appeal in the U.S. was to a younger tech-savvy audience looking to access the shares market,” David Brear, CEO at fintech consultancy 11FS and co-host of the Fintech Insider Podcast, told TechCrunch. “It’s likely they’ll appeal to a similar audience in the U.K. who have previously found the price and access barrier to the stock market too high. I can see them going head-to-head with Freetrade in terms of target market to start, and then moving on to target a more investment savvy audience such as Hargreaves Lansdown users, with bigger investment wallets.”

Robinhood, for its part, has been making noises about entering the U.K. for much of this year. At its Q3 earnings this month, the company confirmed it would launch brokerage operations in the U.K. imminently, with crypto trading to follow for European Union (EU) markets. The first of these pledges has now come to fruition, with U.K. consumers able to trade thousands of U.S. stocks, including those of all the major companies such as Apple, Amazon, Microsoft and Meta.

Users can place trades during standard market hours, which is 9:30 a.m. Eastern Time (ET) until 4 p.m., which translates into 2:30 p.m.-9 p.m. U.K. time. Outside those hours, Robinhood’s 24 Hour Market enables users to place so-called limit orders on 150 different stocks 24 hours a day, five days a week, running from 1 a.m. (U.K. time) on Monday through 1 a.m. on Saturday.

Additionally, the company also supports American Depository Receipts (ADRs), which allows customers to invest in some foreign companies that don’t trade on U.S. stock exchanges.

Lessons learned

Despite the minor neobroker boom since Robinhood’s aborted launch three years ago, Sinclair believes his company is in a strong position to capitalize on what is still a relatively nascent market, and can lean on the experience it has amassed from the U.S. over the past decade.

“I’d say the U.K. is a great opportunity, the market actually really hasn’t been disrupted yet,” Sinclair said. “It still looks and feels the same way it did, with traditional brokers dominating with high fees — and that hasn’t changed. So I’d say the opportunity still exists. We have the benefit of a 10-year-old platform in the U.S. that has developed and matured — we’ve added a lot of products and features, we’ve learned from 23 million customers.”

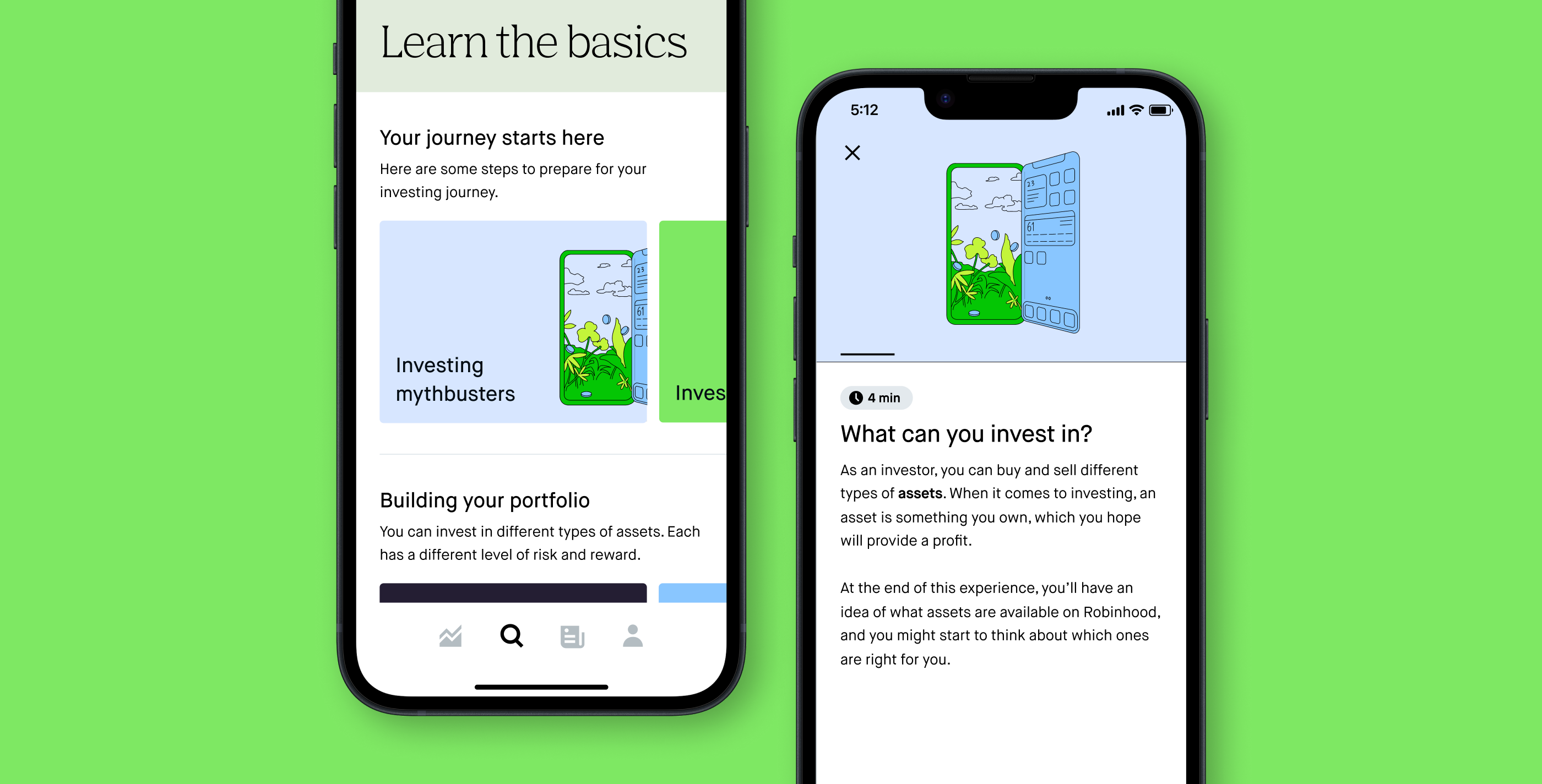

While the company has faced scrutiny over how it targets inexperienced traders in the U.S., Robinhood is taking those lessons into its U.K. foray with in-app guides, tips, tutorials, data and market news, designed to arm fledgling traders with the tools to invest wisely — or, at least, not blow their entire savings — without having to context-switch between multiple information sources.

“This is all about putting it in one place for a customer, so they can facilitate all of that research and all that information before they make trades and to guide their investment strategy going forward,” Sinclair said.

What’s clear from all this is that Robinhood is trying to start on the right-footing after missteps in its home-market — from the get-go in the U.K., the company is introducing 24/7 support via in-app chat, as well as email and phone support from 9 a.m.-9 p.m. But despite these recent efforts to improve its image domestically, the company might still be struggling to recover from recent controversies, according to Brear.

“Robinhood saw tremendous growth in the U.S. during the peak of COVID when everyone was spending a lot more time indoors and online,” Brear said. “They benefited from a wave in hype around the product and the brand which then suffered significantly after the suicide of a 20-year-old customer, and it hasn’t quite recovered since. Much has been written about Robinhood’s responsibility to educate their customers about their product and safely engaging their money in the stock market, and even though they’ve invested in more customer education in the product and through content, their reputation probably hasn’t quite recovered since.”

Two years after going public, though, the most obvious way for Robinhood to grow is through entering new markets, and as one of the world’s major financial centers, the U.K. makes a great deal of sense for its first move.

“The U.K. is a super appealing market for fintechs for a bunch of reasons — a strong and collaborative regulator, a significant affluent fintech-engaged population, lots of talent and a whole landscape of other fintechs and banks available as potential partners or suppliers,” Brear said.

Show me the money

Robinhood promises commission-free trades and no foreign exchange (FOREX) fees, while there are no account minimums either (i.e. users don’t have to deposit x amount to use the service). This all sounds great, but it begs one simple question: How will Robinhood make money?

In the U.S., the Securities and Exchange Commission (SEC) criticized Robinhood for misleading customers over how it makes money. Indeed, while Robinhood is commission-free, it essentially accepts the customer’s trade and sells it on to larger trading firms which executes the trade on behalf of the customer — this is a process known as “payment for order flow” (PFOF). Thus, critics argue, Robinhood customers receive inferior prices for their trades, making the “free-trading” mantra little more than a marketing illusion — the investor themselves essentially become the product.

All of this, though, is moot for Robinhood’s entry to the U.K. Indeed, PFOF has effectively been banned there since 2012, while the European Union (EU) is also introducing a ban on the practice, which is set to come in by 2026. Elsewhere, Canada has also banned PFOF, as has Singapore, while Australia is moving in that direction.

The SEC had previously indicated that it might consider a PFOF ban, though it has retreated from that stance for now. But it’s clear that the global regulatory landscape is increasingly taking a dim view of PFOF, leading Robinhood to pursue different revenue streams.

Last year, Robinhood launched a new program that allows users to “lend” out their stocks to other users, with Robinhood taking a cut of the spoils, while it also introduced a new retirement product. Long before all that, the company rolled out a subscription-based Robinhood Gold product with premium features, while it had also been moving further into crypto territory, though it recently restricted some of the crypto it supports due to regulatory scrutiny in the U.S.

It’s worth noting that these moves are also designed to appease Wall Street. Since going public more than two years ago, the company’s market cap has fallen from a near-$60 billion peak in 2021 to a little over $7 billion today. Trading volume is also down overall on the Robinhood platform, while news emerged this month that Google’s parent Alphabet had ditched its remaining stake in the company, having initially invested when it was still a private startup.

All this points to a company that has not been faring particularly well, making revenue diversification and its impending U.K. launch all the more vital to its future. While there is no obvious moneymaking model in place for Robinhood’s U.K. launch, Sinclair said that it plans to “add products over time,” which might include introducing existing products such as Robinhood Retirement and Robinhood Gold to the market.

“We’re gonna build a diversified revenue stream, there’s products on our roadmap that we’ll deliver, and local products is an important component for us,” Sinclair said. “What we’ve delivered in the U.S. really shows how diversified we can be.”

What is also notable here is that while Robinhood is only bringing its stock-trading product to the U.K., the company is set to launch crypto trading in the European Union (EU). This is due to new EU rules coming into force next year focused on so-called “stablecoins” that are pegged to official currencies, bringing a clearer legal framework for crypto companies to work within.

No such legislation yet exists in the U.K., though there are signs it might fall into step with the EU at some point.

“For the U.K., we’re focused on launching brokerage, that’s our priority and we’re gonna get that right and then look to expand internationally with our brokerage business over time,” Sinclair said. “Our crypto business will be in the EU, and in time we’ll consider it in the U.K. — but for now, our focus is on brokerage.”

On a similar note, Robinhood’s U.K. launch is notable insofar it only supports U.S.-listed stocks — this does actually make sense for the most part, as it will appeal to a new generation of retail traders, ones well-versed in the fortunes of Apple, Amazon, Meta, Tesla, Spotify, et al.

However, Sinclair says it will look to open things up to additional stocks in the future.

“It’s absolutely on our plan — U.K. equities is something we hear from customers, that’s important to them,” Sinclair said. “We’re starting with U.S. stocks, as it leverages our platform and our technology in the U.S. But absolutely — U.K. is on our roadmap.”

Comment