Abstract

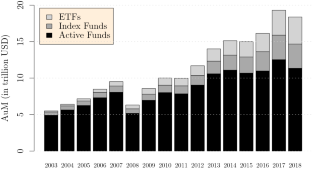

Exchange-traded funds (ETFs) belong to the fastest growing investment products worldwide. Within 15 years, total assets invested in ETFs have twenty-folded, reaching over $3.7 trillion at the end of 2018. Increasing demand for passive investments, coupled with high liquidity and low transaction costs, are key advantages of ETFs compared to their closest substitutes such as traditional index funds. Besides the continuous growth of ETFs, the Flash Crash in 2010 triggered detailed investigations by regulators on how ETFs affect the financial market. This literature review provides a broad overview of recent academic studies analyzing the effect of ETFs on liquidity, price discovery, volatility, and comovement of the underlying securities.

Similar content being viewed by others

References

Adams, Z., Glück, T.: Financialization in commodity markets: a passing trend or the new normal? J. Bank. Finance 60, 93–111 (2015)

Agapova, A.: Conventional mutual index funds versus exchange-traded funds. J. Financial Markets 14, 323–343 (2011)

Agarwal, V., Hanouna, P.E., Moussawi, R., Stahel, C.W.: (2018) Do ETFs increase the commonality in liquidity of underlying stocks? Working paper, Villanova University

Antoniewicz, R.S., Heinrichs, J.: (2014) Understanding exchange-traded funds: How ETFs work. In: ICI Research Perspective, vol. 20, pp. 11–13

Appel, I.R., Gormley, T.A., Keim, D.B.: Passive investors, not passive owners. J. Financ. Econ. 121, 111–141 (2016)

Bae, K.H., Wang, J., Kang, J.K.: (2012) The costs of ETF membership: valuation effect of ETFs on underlying firms, Working paper, York University

Barberis, N., Shleifer, A., Wurgler, J.: Comovement. J. Financ. Econ. 75, 283–317 (2005)

Ben-David, I., Franzoni, F., Moussawi, R.: Hedge fund stock trading in the financial crisis of 2007–2009. Rev. Financ. Stud. 25, 1–54 (2012)

Bae, K.H., Wang, J., Kang, J.K.: (2016) Exchange traded funds (ETFs), Working paper, Ohio State University

Ben-David, I., Franzoni, F., Moussawi, R.: Do ETFs increase volatility? J. Finance 73, 2471–2535 (2018)

Blocher, J., Whaley, R.E.: (2016) Two-sided markets in asset management: exchange-traded funds and securities lending, Working paper, Vanderbilt University

Boehmer, B., Boehmer, E.: Trading your neighbor’s ETFs: competition or fragmentation? J. Bank. Finance 27, 1667–1703 (2003)

Borkovec, M., Domowitz, I., Serbin, V., Yegerman, H.: Liquidity and price discovery in exchange-traded funds: one of several possible lessons from the flash crash. J. Index Invest. 1, 24–42 (2010)

Bradley, H.S., Litan, R.E.: (2010) Choking the recovery: why new growth companies aren’t going public and unrecognized risks of future market disruptions, Working paper, Ewing Marion Kauffman Foundation

Bradley, H.S., Litan, R.E.: (2011) ETFs and the present danger to capital formation, Working paper, Ewing Marion Kauffman Foundation

Carhart, M.M.: On persistence in mutual fund performance. J. Finance 52, 57–82 (1997)

Carlson, M. (2007) A brief history of the 1987 stock market crash with a discussion of the federal reserve response, Working paper, Finance and Economics Discussion Series

CFTC (2010a) Findings regarding the market events of may 6, 2010, Report of the Staffs of the CFTC and SEC to the Joint Advisory Committee on Emerging Regulatory Issues

CFTC (2010b) Preliminary findings regarding the market events of may 6, 2010, Report of the Staffs of the CFTC and SEC to the Joint Advisory Committee on Emerging Regulatory Issues

Chan, W., Shelton, B., Wu, Y.: Volatility spillovers arising from the financialization of commodities. J. Risk Financ. Manag. 11, 72 (2018)

Chang, Y.-C., Hong, H., Liskovich, I.: Regression discontinuity and the price effects of stock market indexing. Rev. Financ. Stud. 28, 212–246 (2015)

Cheng, M., Madhavan, A.: The dynamics of leveraged and inverse exchange-traded funds. J. Invest. Manag. 7, 43–62 (2009)

Curcio, R.J., Anderson, R.I., Guirguis, H., Boney, V.: Have leveraged and traditional ETFs impacted the volatility of real estate stock prices? Appl. Financ. Econ. 22, 709–722 (2012)

Da, Z., Shive, S.: (2013) When the bellwether dances to noise: evidence from exchange-traded funds, Working paper, University of Notre Dame

Dannhauser, C.D.: The impact of innovation: evidence from corporate bond ETFs. J. Financ. Econ. 125, 537–560 (2017)

Deville, L., Gresse, C., de Séverac, B.: Direct and indirect effects of index ETFs on spot-futures pricing and liquidity: evidence from the CAC 40 index. Eur. Financ. Manag. 20, 352–373 (2014)

Diebold, F.X., Yilmaz, K.: Better to give than to receive: predictive directional measurement of volatility spillovers. Int. J. Forecast. 28, 57–66 (2012)

Engle, R.: Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 20, 339–350 (2002)

Foucher, I., Gray, K.: Exchange-traded funds: evolution of benefits, vulnerabilities and risks. Bank Canada Financ. Syst. Rev., 37–46 (2014)

Gastineau, G.L.: Exchange-traded funds. J. Portf. Manag. 27, 88–96 (2001)

Glosten, L., Nallareddy, S., Zou, Y.: (2015) ETF trading and informational efficiency of underlying securities. Management Science. forthcoming

Greenwood, R.M., Sosner, N.: Trading patterns and excess comovement of stock returns. Financ. Anal. J. 63, 69–81 (2007)

Gruber, M.J.: Another puzzle: the growth in actively managed mutual funds. J. Finance 51, 783–810 (1996)

Hamm, S.J.W.: (2014) The effect of ETFs on stock liquidity, Working paper, Tulane University

Hegde, S.P., McDermott, J.B.: The market liquidity of DIAMONDS, Q’s, and their underlying stocks. J. Bank. Finance 28, 1043–1067 (2004)

Hill, J.M.: The evolution and success of index strategies in ETFs. Financ. Anal. J. 72, 8–13 (2016)

Investment Company Institute (2019) Investment company fact book–a review of trends and activities in the U.S. investment company industry, vol. 59, pp. 194–202

Israeli, D., Lee, C., Sridharan, S.: Is there a dark side to exchange traded funds? An information perspective. Rev. Account. Stud. 22, 1048–1083 (2017)

Jensen, M.C.: The performance of mutual funds in the period 1945–1964. J. Finance 23, 389–416 (1968)

Krause, T., Ehsani, S., Lien, D.: Exchange-traded funds, liquidity and volatility. Appl. Financ. Econ. 24, 1617–1630 (2014)

Lettau, M., Madhavan, A.: Exchange-traded funds 101 for economists. J. Econ. Perspect. 32, 135–153 (2018)

Lin, C.-C., Chiang, M.-H.: Volatility effect of ETFs on the constituents of the underlying Taiwan 50 Index. Appl. Financ. Econ. 15, 1315–1322 (2005)

Madhavan, A.: Exchange-traded funds, market structure, and the flash crash. Financ. Anal. J. 68, 20–35 (2012)

Madhavan, A., Sobczyk, A.: Price dynamics and liquidity of exchange-traded funds. J. Invest. Manag. 14, 1–17 (2016)

Malamud, S.: (2016) A dynamic equilibrium model of ETFs, Working paper, Swiss Finance Institute

Marshall, B.R., Nguyen, N.H., Visaltanachoti, N.: (2015) ETF liquidity, Working paper, Massey University

Morck, R., Yang, F.: (2001) The mysterious growing value of S&P 500 membership, Working paper, University of Alberta

Pan, K., Zeng, Y.: (2017) ETF arbitrage under liquidity mismatch, Working paper, Harvard University

Richie, N., Madura, J.: Impact of the QQQ on liquidity and risk of the underlying stocks. Q. Rev. Econ. Finance 47, 411–421 (2007)

Staer, A., Sottile, P.: Equivalent volume and comovement. Q. Rev. Econ. Finance 68, 143–157 (2018)

Trainor, W.J.: Do leveraged ETFs increase volatility. Technol. Invest. 1, 215–220 (2010)

U.S Securities and Exchange Commission (1988) The October 1987 market break, A report by the Division of Market Regulation

Wang, H., Xu, L.: Do exchange-traded fund flows increase the volatility of the underlying index? Evidence from the emerging market in China. Account. Finance 58, 1525–1548 (2019)

Wermers, R., Xue, J.: (2015) Intraday ETF trading and the volatility of the underlying, Working paper, University of Maryland

Wurgler, J.: (2010) On the economic consequences of index-linked investing, Working paper, New York University

Acknowledgements

The author thanks Prof. Dr. Manuel Ammann as well as Prof. Dr. Markus Schmid for their constructive and insightful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Liebi, L.J. The effect of ETFs on financial markets: a literature review. Financ Mark Portf Manag 34, 165–178 (2020). https://doi.org/10.1007/s11408-020-00349-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-020-00349-1