Highlights

- Bitcoin price surpasses the $50,000 mark for the first time in over two years, sparking market excitement.

- Technical indicators and Bitcoin Futures Open Interest suggest optimism in the crypto market.

- Market sentiment is mixed, with the Fear and Greed Index showing extreme greed, while RSI points to an overbought condition.

Bitcoin price’s remarkable surge past the $50,000 mark for the first time in over two years has created a buzz across both the crypto market and traditional financial segments. Meanwhile, the gains in Bitcoin price have also triggered a rally in several other altcoins. However, amid this meteoric rise, the question on everyone’s mind: will this crypto rally be sustained or will the price face a significant pullback?

As indicators flicker between bullish and cautionary signals, investors are on edge, monitoring every move. So, let’s explore the data and expert opinions to decipher Bitcoin’s potential next move.

Crypto Market Rally To Continue?

Amid the buzz surrounding Bitcoin price’s recent ascent, technical indicators paint a picture of optimism. Bitcoin Futures Open Interest (OI) has witnessed a notable surge, reflecting growing interest and activity in the market. As per CoinGlass data, the OI spiked by 7.58% to reach $23.48 billion or 468.20K BTC, with exchanges like CME and Binance witnessing significant upticks. In addition, the Coinbase Premium Gap soared to 24.54 on February 12, indicating robust demand and premium prices for Bitcoin.

Meanwhile, investors are also keeping a close watch on indicators like the Fear and Greed Index, and Relative Strength Index (RSI) for more cues on the potential upcoming movement of Bitcoin price. Meanwhile, Bitcoin’s Fear and Greed index signals extreme greed among investors, hovering near the 80 mark, while the overall crypto market stood at 72.

However, as Bitcoin price surges, caution looms with its RSI hitting 78, signaling an overbought state. So, the market sentiment remains susceptible to volatility, with profit-taking and fear, uncertainty, and doubt (FUD) lurking in the shadows. Analysts urge investors to exercise prudence amidst the frenzy, emphasizing the need for a balanced approach to decision-making in the unpredictable crypto sphere.

Recommended Articles

Also Read: MicroStrategy’s Bitcoin Boom, Saylor’s Bold Moves Yield 46% Surge in a Week

Expert Insights And Market Dynamics

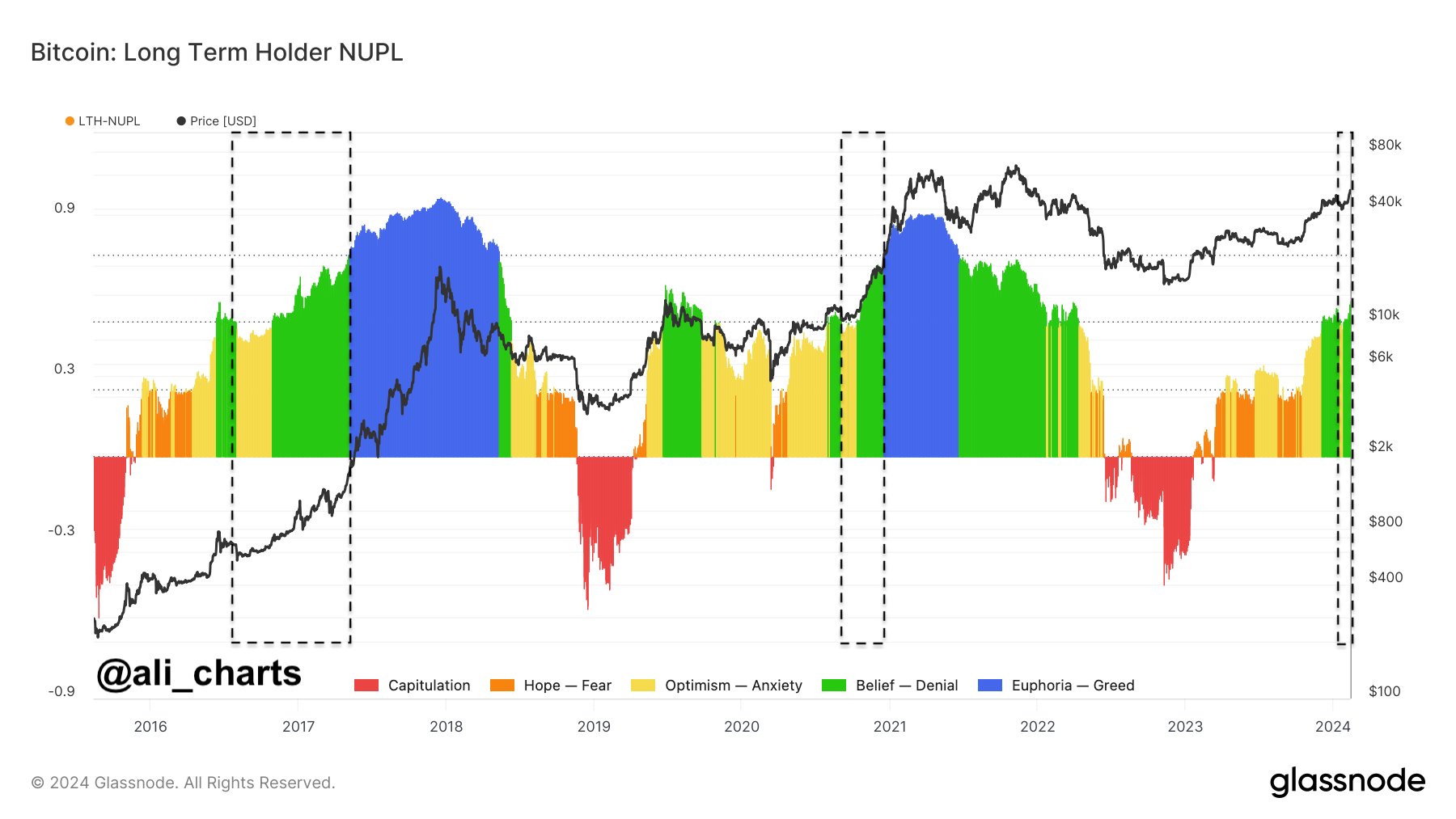

Prominent crypto market analysts are suggesting that Bitcoin’s current trajectory indicates further upward momentum. According to Ali Martinez, a prominent analyst, Bitcoin holders typically undergo a cycle of emotions during bullish periods, recently transitioning from anxiety to belief.

Notably, this sentiment aligns with Stockmoney Lizards’ comment that “$50k is not the end.” However, il Capo Of Crypto anticipates a potential rejection at the $50k level for Bitcoin, with altcoins continuing to surge. These insights hint at a dynamic market landscape, with Bitcoin poised for continued growth amidst fluctuating sentiments and evolving trends.

Meanwhile, several other market pundits are anticipating a further rally in Bitcoin anticipating the impact of the upcoming Bitcoin halving event. Looking at the historical data, previous Bitcoin halving has triggered a significant rally in Bitcoin price.

In addition, the market participants brace as the U.S. anticipates the release of crucial economic data. Today, the U.S. Consumer Price Index (CPI) will be unveiled, followed by the Producer Price Index (PPI) on Friday.

Notably, these indices serve as vital indicators of the nation’s inflationary trends. Despite expectations for multiple rate cuts by the U.S. Federal Reserve, elevated inflation figures may sour market sentiment. Considering that such data could potentially spark significant sell-offs across global financial sectors, including the crypto market.

As Bitcoin continues its dizzying ascent, the stage is set for a showdown between bullish optimism and cautious skepticism. While technical indicators and expert opinions offer divergent narratives, the crypto market remains a volatile arena, susceptible to sudden shifts and external influences.

- Pantera Capital Backs TON with Record-Breaking Investment

- Ethereum Chain Eclipse Founder Steps Back Amid Sexual Accusations

- Chicago Hedge Fund CTC Alternative Holds 685K BlackRock BTC ETF

- Coinbase to List JUP, TNSR, JTO Perpetual Futures

- XRP News Today: Ripple Can Counter SEC’s Attacks on Stablecoin With Binance Ruling

- 2 Crypto To Buy On The Cusp Of Turning $100 Into $10,000 In May

- Litecoin Price Analysis: Is LTC Breaking Out 100 Today?

- Top 3 Price Prediction As Crypto Liquidations Swell To $135M, BTC, ETH, SOL Nosedive?

- Top 3 Crypto Presales Likely To Outperform Bitcoin In 2024

- SOL Price Prediction: Is Solana Falling To $120 This Week?

Mallconomy

Mallconomy  WienerAI

WienerAI