Highlights

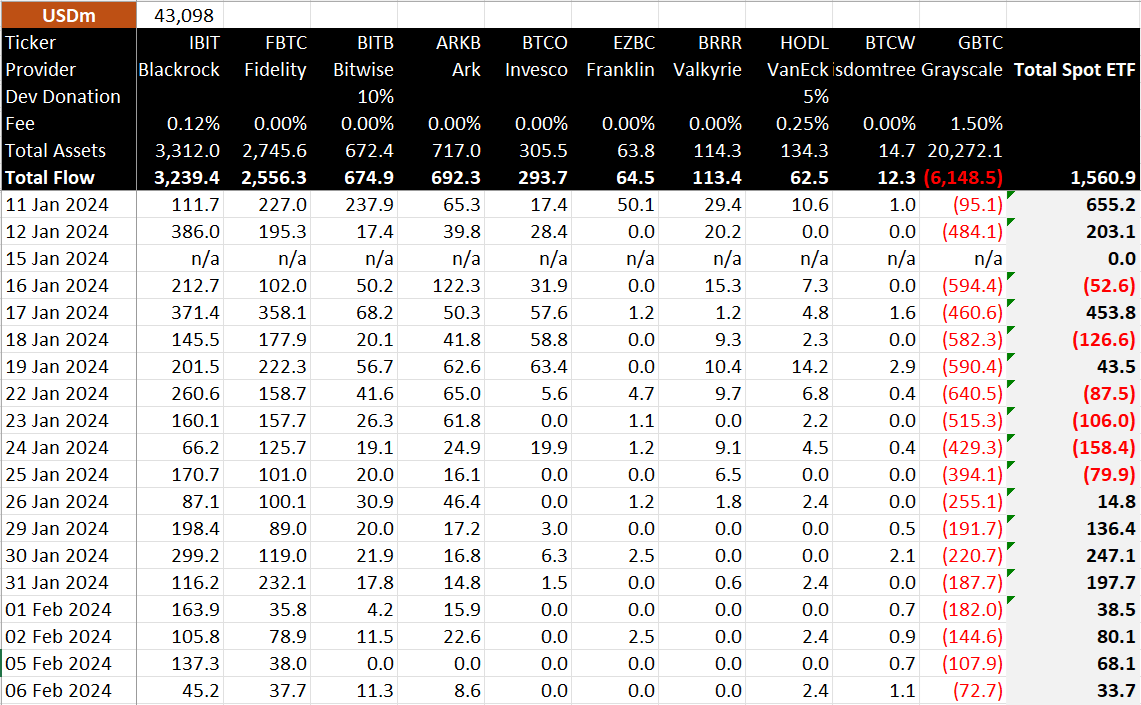

- Spot Bitcoin ETFs net inflows slows to $33 million on Tuesday

- BlackRock Bitcoin ETF (IBIT) inflow dropped to a new low of $45.2 million

- Bitwise, Ark 21 Shares, VanEck and WisdomTree recorded some inflows amid renewed demand

- Grayscale's GBTC slows to a record low of $72.7 million

Most spot Bitcoin ETFs saw a massive drop in inflows on Tuesday as demand and liquidity dries up, according to the latest data by BitMEX Research. Interestingly, Grayscale Bitcoin Trust (GBTC) spot Bitcoin ETF outflow drops to a record low.

Spot Bitcoin ETFs Net Inflows Slows to $33 Million

BitMEX Research in the latest spot Bitcoin ETFs inflow report on February 7 revealed that total inflows for 10 Bitcoin ETFs dropped to just $33.7 million. Despite recording multiple net outflows, this is the second-lowest inflow for 10 spot Bitcoin ETFs after a $14.8 million inflow on January 26.

Inflows for BlackRock Bitcoin ETF (IBIT) dropped to a new low of $45.2 million. BlackRock Bitcoin ETF saw a $137.3 inflow a day earlier, raising speculation of return in demand for the Bitcoin ETF. Fidelity’s FBTC also saw a drop in inflow of $37.7 million.

Bitcoin ETFs of Bitwise, Ark 21 Shares, VanEck and WisdomTree recorded rise in inflows of $11.3, $8.6, $2.4, and $1.1, respectively. Bloomberg senior ETF analyst Eric Balchunas said all underperforming Bitcoin ETFs have the potential to perform in the future.

Grayscale Outflow Slows

Outflows from Grayscale’s GBTC slows to a record low of $72.7 million since the approval of spot Bitcoin ETF by the U.S. SEC on January 11. GBTC saw a $107.9 million outflow on Monday, February 5.

Recommended Articles

The decline in GBTC outflows indicates an imminent end to the mass exodus on the Bitcoin ETF. Experts believe it will positively affect the crypto market and Bitcoin price. GBTC is the liquidity leader in the category. Grayscale will need a robust derivatives ecosystem developed around underlying ETF if they wants to remain a leader and continue to charge high fees. Currently, GBTC charges 1.5% management fees for its spot Bitcoin ETF.

CME Tops Binance Again

Bitcoin Futures open interest (OI) on CME has surpassed Binance again. Crypto exchange Binance recently topped CME to become a leading Bitcoin futures exchange for just two days.

With a notional open interest (OI) of 106,090 BTC valued at $4.55 billion, CME is now the largest Bitcoin futures exchange again after a nearly 5% rise in Bitcoin futures open interest. Binance ranks second, with a notional open interest of 103,660 worth $4.46 billion.

Also Read:

- XRP Lawsuit: Ripple Requests Judge Torres to Extend Remedies Discovery Deadline

- Bank Run: Bitcoin Bull Says NYCB on Brink of Bankruptcy After Downgrade And Lawsuit

- South Korea To Probe OKX Amid Crypto Crackdown, What’s Next?

- Analyst Predicts Ethereum ETF to Trigger Major ETH Market Moves

- Genesis Creditors to Receive 97% Payout by May Following Court Nod

- Terra Luna Classic Community Votes on Reactivating IBC, LUNC Price to Rally?

- US House to Vote on Two Landmark Crypto Bills Next Week

- WIF Selloff Alert: Dogwifhat Tumbles On Multiple Factors

- Shiba Inu Price Analysis Hints 35% Upside as Buyers Break 50-Day Consolidation

- Solana Price Prediction: Can SOL Surpass the $200 Milestone By End Of This Weekend?

- Ethereum Price Analysis: ETH Sees End-of-Correction With This Resistance Breakout

- Turn $1 Into $100 This Week With 3 Altcoins To Buy

- Crypto Market Analysis 18/5: Will Bitcoin Regain $70000 this Weekend?