Highlights

- BlackRock iShares Bitcoin ETF witnessing an inflow of $520 million

- Spot Bitcoin exchange-traded funds (ETF) witnessed $577 million net inflow

- BTC price breaks over $60,000 on the back of massive Bitcoin ETF demand

The week is turning out to be great for spot Bitcoin ETFs as they started the week with a $520 million inflow on Monday and recorded another strong inflow of $577 million on Tuesday. The massive inflow came on the back of BlackRock iShares Bitcoin ETF witnessing an inflow of $520 million alone, triggering a BTC price rally to $60,000.

BlackRock Leads Spot Bitcoin ETF Inflow

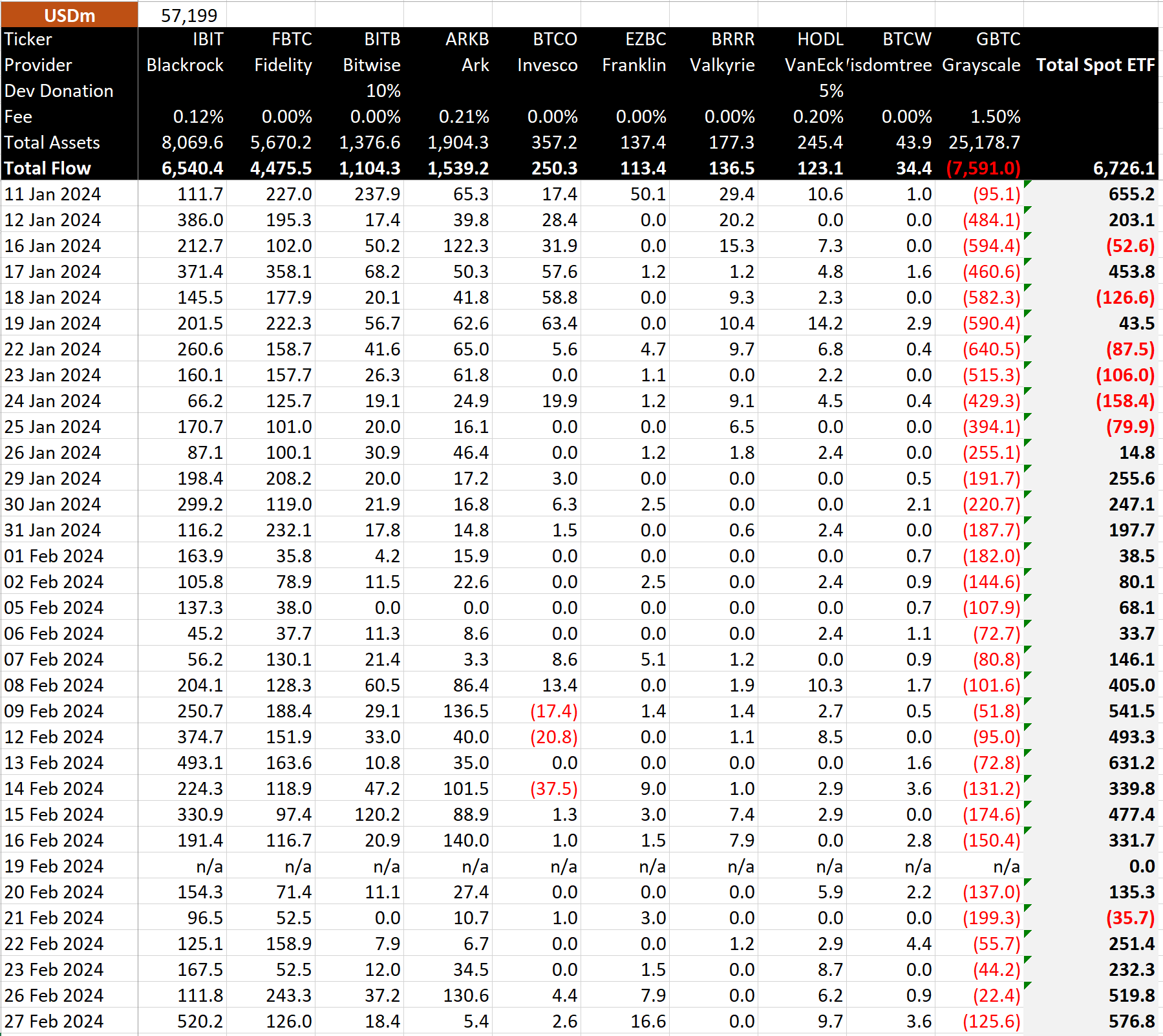

Spot Bitcoin exchange-traded funds (ETF) witnessed $577 million net inflow (or 10,167.5 BTC net inflow) on February 27, according to data by BitMEX Research. This was the third-largest inflow until launch, as all nine spot Bitcoin ETFs recorded massive trading volumes. However, Grayscale’s GBTC outflow increased again on Tuesday after dropping to $22.4 million a day before.

BlackRock iShares Bitcoin ETF (IBIT) saw over $520 million, breaking its largest inflow to date record. IBIT also saw a record $1.3 billion trading volume, exceeding the daily trade volume of most large-cap US stocks. Following the latest inflow, BlackRock’s net inflow hit over $6.5 billion and asset holdings jumped over 141,000 BTC.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $126 million and $5.4 million, respectively. Bitwise (BITB), VanEck (HODL), and others spot Bitcoin also saw substantial inflows, indicating strong bullish sentiment among retail and institutional investors.

Notably, GBTC saw a $125.6 million outflow, an increase from Monday’s $22.4 million outflow, setting aside hopes of a paradigm shift. Bloomberg senior ETF analyst Eric Balchunas said the daily trading volume of nine new spot Bitcoin ETFs except GBTC exceeded $2 billion for the second consecutive day as BTC price holds strongly above $57K.

Recommended Articles

Also Read: Sam Bankman-Fried’s Defense Counsel Proposes 6 Year Sentence or Less

BTC Price Breaks Above $60,000

Crypto Fear & Greed Index has reached a 4-year high value of 82 today, with the market sentiment currently in the ‘Extreme Greed’ zone. The FOMO reaches into Wall Street as traders’ interest in BTC is extremely high. Experts predicted BTC price to hit $60,000 before bitcoin halving.

BTC price skyrocketed to $60,000, less than a few percentage away from the $68.6K high established 27 months ago. The 24-hour low and high are $56,329 and $60,450, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating interest among traders.

Good morning,#Bitcoin is above $58K, where funding rates are going through the roof.

Astonishing strength, definitely areas to start looking for profits. pic.twitter.com/WXRzkEkaBA

— Michaël van de Poppe (@CryptoMichNL) February 28, 2024

Also Read: US SEC Request Judge Torres to Extend Remedies Briefing Deadlines in Ripple Case

- Crypto Prices Today May 18: Bitcoin Nears $67K As Ethereum, Solana, XRP Rally

- Dogecoin Whale Offloads 120M Coins To Robinhood, DOGE Price At Risk?

- Spot Bitcoin ETFs Net $1.3B in May, Reversing April’s $344M Outflows

- Ripple Spotlights $865M XRP Volume Amid SEC Lawsuit: Report

- Dogwifhat (WIF) Sees 1.61% Drop in Price as Bearish Sentiment Prevails

- Bitcoin Price Analysis: Why BTC Rise to $67k Hints End of Correction Trend

- Expert’s Top 3 Bitcoin Spinoffs With 100X Potential Before June

- Chainlink Price Analysis: Whale Accumulation Positions LINK for $20 Breakout

- Bonk Price Prediction: Bullish Reversal Pattern Signals Upside Potential of 22%

- XRP Price Forecast: Could a Bullish Momentum Drive the Price to $1 Amid SEC Ruling?