Highlights

- Spot Bitcoin ETFs recorded inflow of more than $323 million on February 16

- BlackRock's iShares Bitcoin ETF holdings surpassed $6.2 billion

- Bitcoin price moves sideways due to fewer sellers amid bullish sentiment

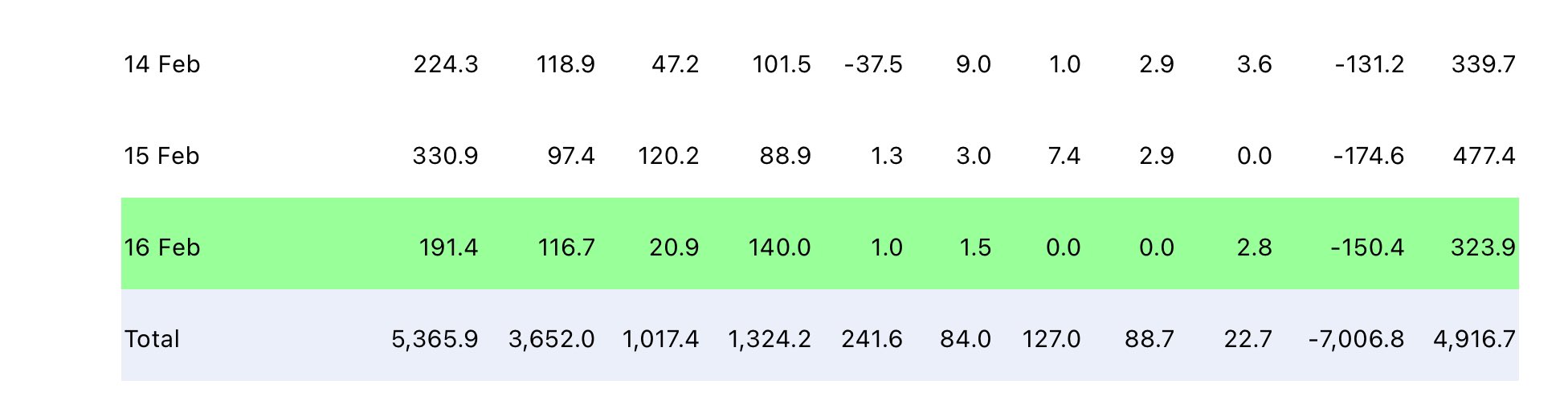

Spot Bitcoin ETFs ended the week with $323.90 million inflows on Friday, slightly lower than the $477 million Bitcoin ETF inflow on Thursday. The Bitcoin ETFs typically have high net inflow on last trading days of the week, but a possible supply crunch over high demand and fewer Bitcoin sellers caused a slowdown.

Bitcoin ETF Net Inflows

According to the latest data by Farside, spot Bitcoin ETFs saw $323.90 million net inflow on Friday. Following the latest inflow, Bitcoin ETFs have now recorded a net inflow of nearly $5 billion. It means over 100,000 BTCs have moved into spot Bitcoin ETFs since launch.

BlackRock’s iShares Bitcoin ETF (IBIT) saw another enormous inflow of $191.4 million on Friday, with the total inflow to date surpassing $5.36 billion. IBIT leads by a wide margin, with BTC holdings of more than 119.6K valued at over $6.2 billion.

On Friday, Ark 21Shares Bitcoin ETF (ARKB) recorded second highest inflow of $140 million. Followed by $116.7 million in Fidelity Bitcoin ETF (FBTC) and $20.9 million in Bitwise Bitcoin ETF (BITB).

Grayscale Investments’ GBTC witnessed $150.4 million outflow, slowing from Thursday’s outflow of $174.6 million. Thus, the net inflow for spot Bitcoin ETFs, excluding GBTC, was actually $474.3 million. Meanwhile, GBTC net outflow has now surpassed 7 billion.

Also Read: Coinbase Custody Alone Manages 90% of All Bitcoin ETFs Assets

BTC Price Steady at $52K

BTC price moving range bound near the $52K level, with the price currently trading at $51,944. The 24-hour low and high are $51,641 and $52,537, respectively. Price movements were volatile after the US PPI release on Friday.

Furthermore, the trading volume has decreased further by 28% in the last 24 hours, indicating a decline in interest among traders as price moves sideways. Analysts predicted sideways or down movements in the next few days.

The significant inflow into BTC ETFs is poised to impact the crypto market dynamics profoundly. On-chain data providers, including CryptoQuant, suggest that the sustained buying pressure from these ETFs could propel Bitcoin’s price to new heights.

Also Read: Bitcoin (BTC) Retail Participation Drops But Institutions Contribute to Supply Squeeze

- Why Is Bitcoin Price Up Despite US Stock Market Crash?

- Pi Network Buy The Dips, Next Pi Coin Price Target $0.1 or $1?

- PayPal Adds Chainlink And Solana To Its US Cryptocurrency Service

- US SEC Rules Dollar-Backed Stablecoins Are Not Securities Under Federal Laws

- XRP News: Ripple Whales Move $572 Million, What Is Going On?

- Pi Network Price Surges As Trading Volumes Approach $1B

- XRP Price At a Crossroads As Wedge Pattern Signals 70% Crash or 700% Surge

- XRP Price Sees 12% Gains as China Tariffs Sparks Bitcoin Price Rally

- Ethereum Price Prediction: Falling Wedges Pattern hints China tariff tailwinds could lift by ETH 250%

- Bitcoin Price Prediction: $90K Breakout Ahead as BTC Decouples from US stocks after China’s Tariffs